6 Simple Techniques For Paul B Insurance Medicare Advantage

Table of ContentsNot known Facts About Paul B Insurance Medicare AdvantagePaul B Insurance Medicare Advantage - TruthsUnknown Facts About Paul B Insurance Medicare AdvantagePaul B Insurance Medicare Advantage for BeginnersSome Ideas on Paul B Insurance Medicare Advantage You Should KnowPaul B Insurance Medicare Advantage Things To Know Before You Get ThisExcitement About Paul B Insurance Medicare AdvantageThe Facts About Paul B Insurance Medicare Advantage RevealedWhat Does Paul B Insurance Medicare Advantage Mean?

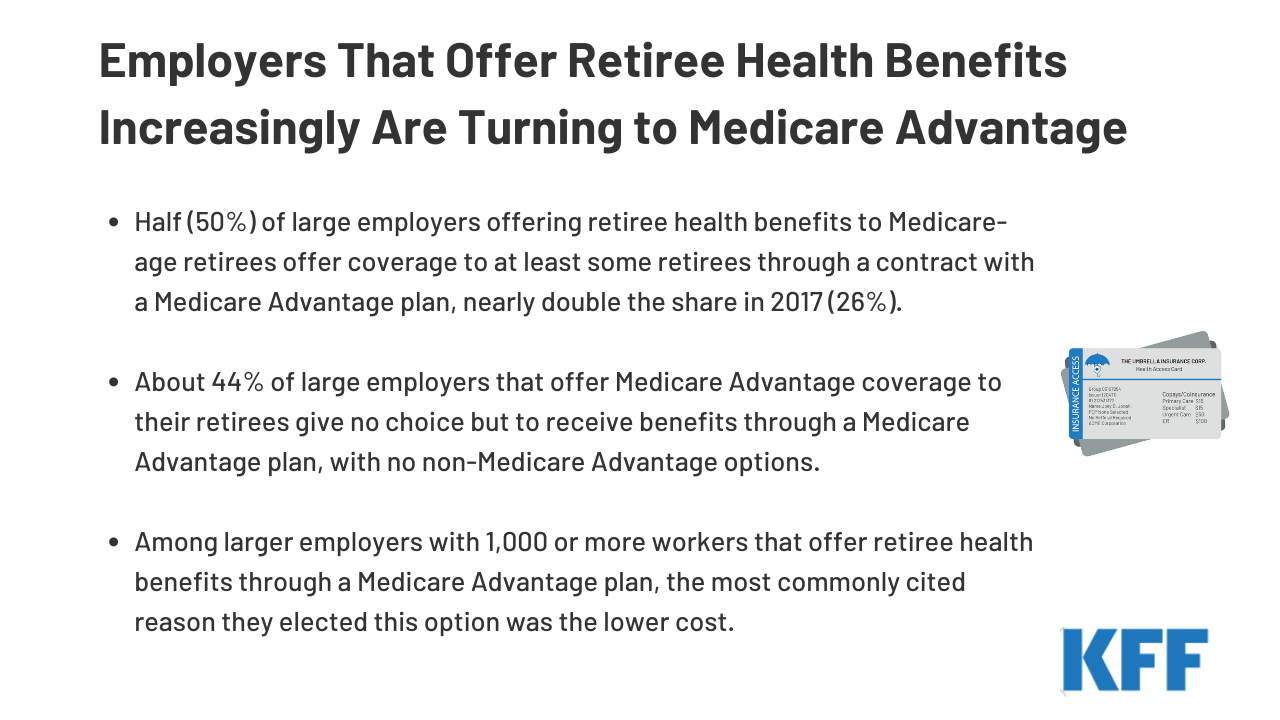

When the law was very first passed, many individuals consisting of the CBO predicted that Medicare Advantage registration would drop significantly over the coming years as payment reductions forced strategies to use less advantages, greater out-of-pocket costs, and narrower networks. However that has actually not been the case at all. Medicare Advantage registration continues to grow each year (paul b insurance medicare advantage).

The smart Trick of Paul B Insurance Medicare Advantage That Nobody is Talking About

There are plans that permit you to include a lot more oral and vision coverage.

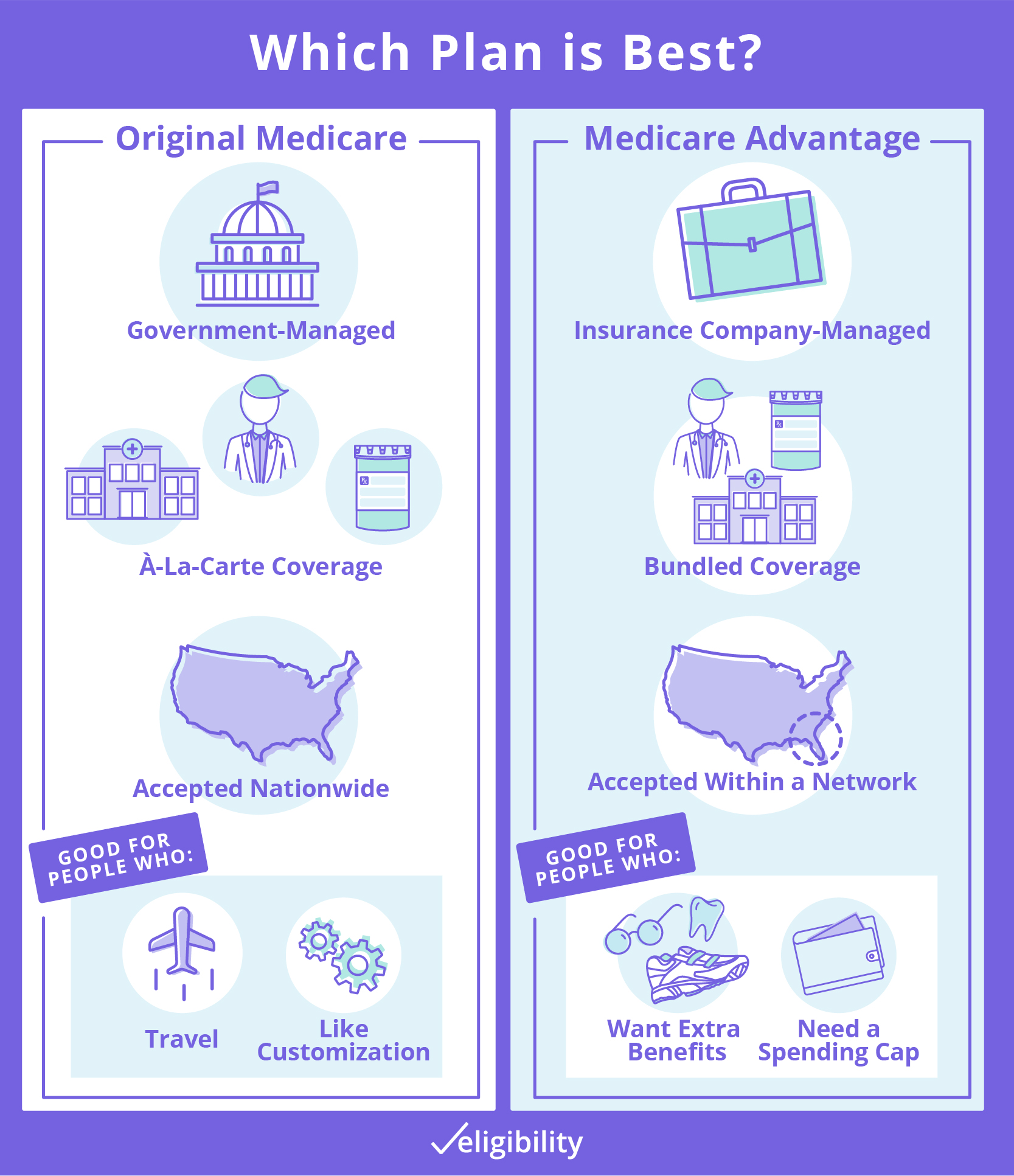

There are 2 primary ways to get Medicare coverage: Initial Medicare, A Medicare Benefit Strategy Original Medicare includes Part A (healthcare facility insurance coverage) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to purchase supplemental insurance coverage understood as Medigap (or Medicare Supplement Insurance Coverage).

9 Simple Techniques For Paul B Insurance Medicare Advantage

Medigap policies differ and the most comprehensive protection used was through Strategy F, which covers all copays and deductibles. Sadly, since January 1, 2020, Strategy F and Plan C, the two plans that covered deductibles can not be sold to brand-new Medicare beneficiaries. Nevertheless, if you were eligible for Medicare prior to that time but have not yet enrolled, you still might have the ability to get Plan F or Plan C.

If you do not buy it when you first end up being eligible for itand are not covered by a drug plan through work or a spouseyou will be charged a lifetime penalty if you shop it later on. A Medicare Advantage Strategy is intended to be an all-in-one alternative to Original Medicare.

The smart Trick of Paul B Insurance Medicare Advantage That Nobody is Discussing

Medicare Benefit Strategies do have a yearly limitation on your out-of-pocket costs for medical services, called the optimum out-of-pocket (MOOP). Once you reach this limit, you'll pay absolutely nothing for covered services. Each plan can have a various limit, and the limitation can change each year, so that's a factor to consider when buying one.

Out-of-pocket expenses can rapidly develop up over the year if you get sick. "The finest prospect for Medicare Benefit is someone who's healthy," says Mary Ashkar, senior lawyer for the Center for Medicare Advocacy.

6 Easy Facts About Paul B Insurance Medicare Advantage Explained

You may not be able to purchase a Medigap policy (if you switch after the aforementioned 12-month limit). If you are able to do so, it may cost more than it would have when you initially enrolled in Medicare. Bear in mind that a company only needs to provide Medigap insurance if you meet specific requirements regarding underwriting (if this is after the 12-month period).

Many Medigap policies are issue-age rated policies or attained-age ranked policies. This means that when you register later in life, you will pay more monthly than if you had started with the Medigap policy at age 65. You may have the ability to discover a read here policy that has no age rating, but those are unusual. paul b insurance medicare advantage.

How Paul B Insurance Medicare Advantage can Save You Time, Stress, and Money.

Before you register in a Medicare Benefit plan it's important to know the following: Do all of your providers (physicians, hospitals, etc) accept the strategy? You must have both Medicare Parts A and B and live in the service area for the plan. You need to remain in the strategy until the end of the fiscal year (there are a few exceptions to this).

Top Guidelines Of Paul B Insurance Medicare Advantage

Medicare Advantage plans, likewise called Medicare Part C strategies, run as private health insurance within the Medicare program, functioning as protection alternatives to Initial Medicare. In a lot of cases, Medicare Benefit plans provide more services at a cost that is the very same or cheaper than the Original Medicare program. What makes Medicare Advantage plans bad is they have more limitations than Original Medicare on which doctors and medical facilities you can use pop over to this site - paul b insurance medicare advantage.

However the majority of the costs with Medicare Advantage plans originated from copays, coinsurance, deductibles and other out-of-pocket expenses that become part of the total care process. And these costs can quickly escalate. If you require costly healthcare, you might end up paying more out of pocket than you would with Original Medicare.

The Facts About Paul B Insurance Medicare Advantage Uncovered

After that deductible is fulfilled, there are no more expenses until the 60th day of hospitalization. A lot of Medicare Advantage strategies have their own policy deductible. However the strategies begin charging copays on the very first day of hospitalization. This suggests a beneficiary might spend more for a five-day healthcare facility stay under Medicare Advantage than Original Medicare.

This is particularly helpful for those who have continuous medical conditions since if you have Parts A and B alone, you will not have a cap on your medical spending. Going outside of the network is enabled under numerous Medicare Benefit chose supplier strategies, though medical expenses are higher than they are when staying within the plan network.

Some Known Facts About Paul B Insurance Medicare Advantage.

Comments on “Paul B Insurance Medicare Advantage Can Be Fun For Anyone”